According to McKinsey & Co., women have accounted for 54 percent of COVID-19-related job losses, despite making up only 39 percent of global employment. It’s being called a “she-cession.”

In the U.S., working mothers have had to endure balancing work and childcare. The same is true for many fathers. However, the responsibility of childcare and remote schooling has mostly been that of mothers, according to U.S. Census real-time, time-use studies.

According to the Labor Department, by the end of 2019, women’s gains in the U.S. workforce pushed the number of female workers higher than males. In particular, the growth of women’s jobs in healthcare helped those gains. According to the U.S. Bureau of Labor Statistics, a year after the pandemic began, the number of jobs held by men now outnumber those held by women.

Since 1975, when the data began to be tracked, women had lost fewer jobs than men during every recession. However, this time has been different. Job losses have been most significant in the service sector. In contrast, traditionally the losses had been in either financial service or manufacturing. Over the last 40 years, the workforce composition became more service-intensive. According to the U.S. Bureau of Labor Statistics, in 2019, 5 out of every 6 private-sector jobs were in the service sector. The pandemic-induced business closings have been the least kind to industries where women hold more positions than men, such as dining, marketing, and retail. Many of those jobs didn’t lend well to telecommuting.

According to the National Bureau of Economic Research, between February and April 2020, women’s unemployment increased by 12.8 percentage points, versus 9.9 for men. On the surface, the unemployment rate of women relative to men has evened out a bit. However, to be counted as officially unemployed, you must not only be out of work but actively looking for a job. Due to frustration and the need to stay home with children, women’s participation rate in the workforce has dropped to its lowest level since 1986, according to the US. Bureau of Labor Statistics.

According to the Federal Reserve Bank of Dallas, during the pandemic, mothers with children under 13 years of age dropped out of the workforce at a rate of almost 2.5-to-1 compared to men. It’s no wonder that nearly 3 in 4 women with investable assets of $100,000 or more said that COVID-19 has jeopardized their ability to retire, according to a survey released in January 2021 by the Nationwide Retirement Institute. The good news, though, is that women have made gains elsewhere. Currently, there are 40 women in charge of Fortune 500 companies.

The bad news for the global economy is that women leaving the workforce is a negative for the global economy. According to McKinsey & Co., by 2030, women leaving the workforce at this rate could reduce the global Gross Domestic Product (GDP) growth by $1 trillion more than it might have fallen otherwise. Conversely, advancing gender equality in the workplace could add as much as $13 trillion. That compares to a roughly $104 trillion global GDP, according to the Organization for Economic Co-operation and Development (OECD). Supporting women in the workplace is not just good for women; it’s good for the world.

I expect the recently passed $1.9 trillion COVID-19 American Rescue Plan will help women’s job growth. The package includes, among other things:

- $1,400 direct payment for many Americans

- $300 per week in supplemental unemployment benefits through September 6

- Making the first $10,200 in assistance tax-free

- $350 billion for state and local government

- $130 billion for K-12 schools’ coronavirus expenses

- $9 billion to state and local governments for COVID-19 vaccine distribution

- $16 for national vaccine distribution

- $20 for the development of more vaccine

- $50 billion for COVID-19 testing

- A $3,600 child tax credit for kids up to the age of 6 and $3,000 for kids up to the age of 17

- $14 billion of payroll support for U.S. airlines

- $32 billion for rental assistance, homelessness, and housing

- $2 billion for food aid

- $28 billion for restaurants and businesses

- $7 billion for more PPP loans

- Health insurance premium subsidies for two years

Economists surveyed by the Wall Street Journal believe this stimulus package will help create jobs for women and men. The economists’ average forecast for 2021 economic growth has moved to 5.95 percent, up from their 4.87 percent forecast last month. That average is lower than the 6.5 percent expectation from the OECD. For comparison, that would be the U.S. economy’s best growth since it achieved 7.9 percent in 1983. Those economists expect economic growth to create an average of 514,000 jobs a month over the next four quarters. That seems like an overly optimistic expectation for jobs, but I agree with the projected trend.

While good news for female and male workers alike, it’ll probably also be a boom to the investor class. Much of the coming $1,400 stimulus payments will find its way to the market. According to Deutsche Bank, those aged 35-50 will invest 37 percent of their checks into the stock market. Those aged 25-34 plan to put 50 percent of their COVID-19 relief checks in stocks. Of those aged 18-24, about 40 percent said they’d buy stocks. Kudos to you young folks!

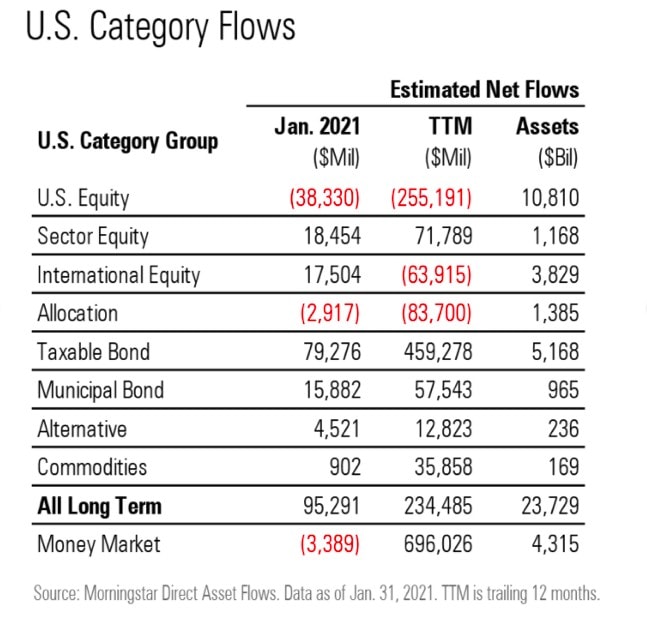

Of the $1.9 trillion package, approximately $400 billion will be direct payments to U.S. households in the form of those $1,400 checks. That could mean nearly $200 billion flowing into stocks. For comparison, according to Morningstar, investors sold $255 billion of U.S. equity funds during the 12 months ending January 31, 2021.

Of the economists surveyed by the Wall Street Journal, 80.6 percent of them expect the stimulus package to push inflation to rise above the Federal Reserve’s 2 percent target. I suspect that might be understated. Given all the stimulus signed into law during the last 12 months, the amount of “excess” savings held by U.S. households, and pent-up demand for purchases, inflationary pressures should come relatively quickly. Considering the expected job growth, I’m sure most of us will be okay paying a little more for our oat milk and avocado toast.

This article originally appeared in The Berkshire Edge on March 15, 2021.