Running a small business is rewarding but demanding, risky and expensive. Sometimes, those and other challenges can be s...

Unlocking the Sale: Strategies for Skilled Professionals to Successfully Exit Their Businesses

After years of hard work, business owners often look forward to a well-deserved retirement. The typical business owner h...

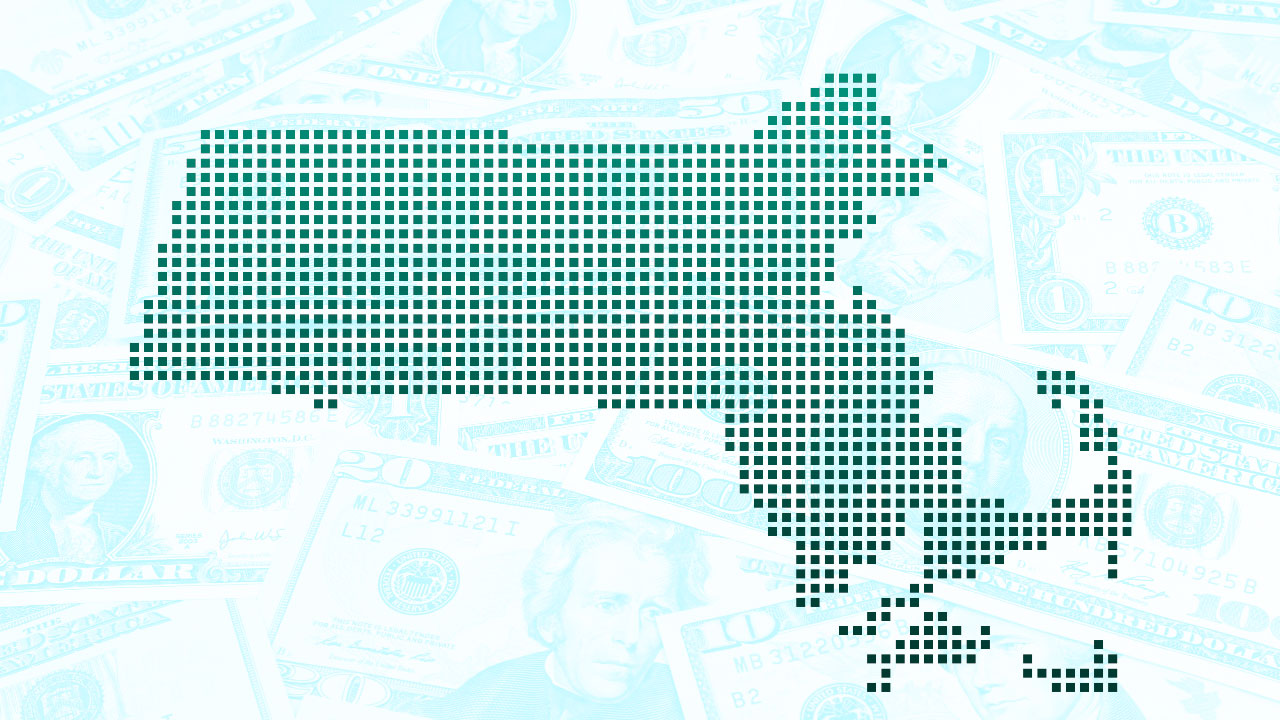

Business owners: 5 ways to avoid the Massachusetts Millionaire’s Tax

If you’re a business owner living in Massachusetts, you may one day sell your company for more than $1 million. Becaus...

Selling your business: Avoid capital gains tax with the Qualified Small Business Stock exclusion

Capital gains taxes can eat up a hefty portion of the profit from the sale of your small business. Luckily, one underapp...

The downside of milking your small business for income

Here’s a business fact you might not know. According to Forbes, 80 percent of businesses never sell. Those that do...

What can business owners learn from the collapse of Silicon Valley Bank?

Silicon Valley Bank was a state-chartered commercial bank in Santa Clara, Calif. A run on the bank’s deposits caused i...

Maximize the value of your business by eliminating headaches

The voice on the phone sounded eager for some help. “I heard that you people can help a guy like me do what it takes t...

How to handle an unsolicited offer

You could be running your business for years with no thought of selling your business, and then you get a call out of th...

The art of selling your business

According to the Business Reference Guide, 80 percent of businesses put on the market do not sell (firms under $50 milli...

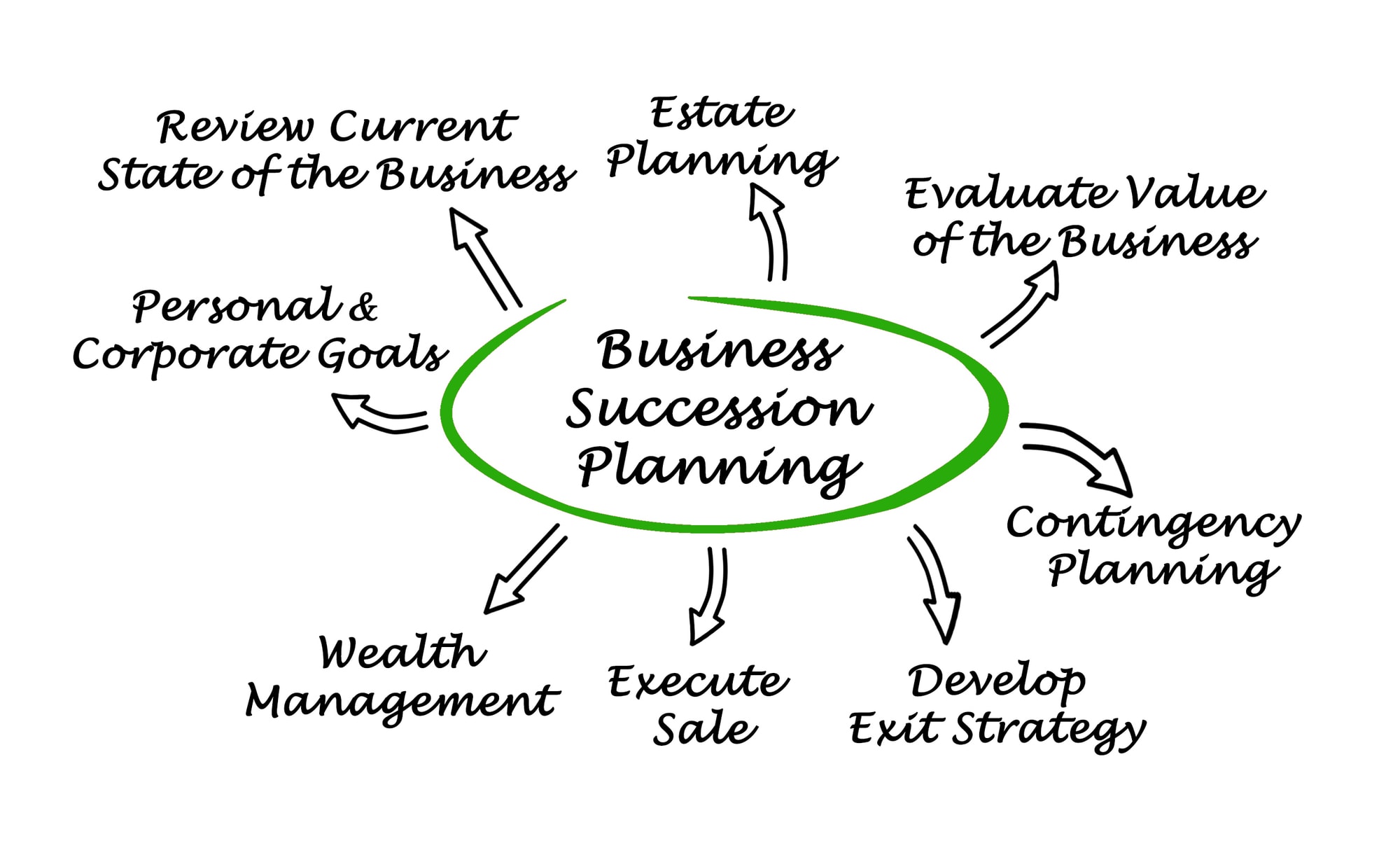

Creating a Successful Business Succession Plan

A good succession plan creates a blueprint for ownership transfer as you exit your business. It helps you prepare for yo...

Improve business value with the 4C’s

The coronavirus pandemic has triggered questions from business owners about how they can minimize the decline in company...

Growth potential

Potential acquirers use 10,001 Hours to perform valuations of their targets. More often than you might expect, the sel...